The Department of Finance (DOF) has unveiled a P 51-billion wage subsidy program for middle class workers employed by small businesses affected by the COVID-19 crisis.

The program covers around 3.4 million workers in the formal sector employed by some 1.5 million businesses that are either forced to shut down or can only operate under skeletal force because of the Luzon-wide enhanced community quarantine or other restrictions imposed in various parts of the country due to the health emergency.

How much is the financial assistance?

The government will provide a wage subsidy of P5,000 to P8,000 per eligible worker based on the monthly regional minimum wage.

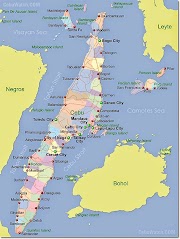

Below are the regions and their corresponding wage subsidy per worker:

- NCR - P8,00

- CAR - P5,500

- I - P5,500

- II - P5,500

- III - P8,000

- IV-A - P8,000

- IV-B - P5,000

- V - P5,000

- VI - P6,000

- VII - P6,000

- VIII - P5,000

- IX - P5,000

- X - P6,000

- XI - P6,000

- XII - P5,000

- CARAGA - P5,000

- BARMM - P5,000

Who is eligible to apply?

Since applications for the wage subsidy program will be undertaken by the employer on behalf of their employees, small business owners must ensure they are not in the Bureau of Internal Revenue’s (BIR) Large Taxpayer Service (LTS) list.

How to verify if the small business is not in LTS?

A small business - whether a corporation, partnership, or sole proprietorship - should visit the BIR’s website www.bir.gov.ph and click the “SBWS” icon in the agency’s homepage.

Then the employer will enter its nine-digit Tax Identification Number (TIN) in the SBWS page’s search field. The taxman strongly recommends that the applicant must check its Certificate of Registration to ensure the accuracy of the information they will provide.

After clicking “Search” the employer or applicant will see if they are qualified for the wage subsidy program. If the applicant is qualified the BIR webpage will flash a “green prompt.”

The applicant should copy the passcode provided by the BIR’s system as this is needed in the next step of application with the Social Security System (SSS).

How to apply with the SSS?

Step 1: After verifying with the BIR SBWS if the small business is eligible, applicants should go to the SSS website (www.sss.gov.ph) and log-in in their My.SSS account.

Step 2: Upon logging in in their respective My.SSS account, the employer should click the “Small Business Wage Subsidy” tab.

Step 3: Applicants should paste or type the passcode provided by the BIR SBWS system and their TIN. After this, applicants should click the “Proceed” button to enter the application portal.

Step 4: Upon entering the system, the applicant will find a list of its employees. The employer should choose eligible employees by clicking a corresponding box at the left side of the employee’s name. The applicant should also click the box at the right side of the employee’s name if the worker is a beneficiary of the DOLE’s COVID-19 Adjustment Measures Program (CAMP).

Step 5: After selecting eligible employees, the employer should type each workers’ respective TINs.

If an employee is not in the SSS list, it means the worker is not registered in the My.SSS portal or the information in the My.SSS account is not sufficient.

Step 6: The employer must click “I Agree” with the Employer’s Undertaking that the information provided in the application are complete, true, and correct; employees were notified of the application and has given explanation for those who qualified and did not qualify for the wage subsidy program; and all employees know why their personal and sensitive information were shared with the SSS, BIR, and DOF and that they have given their full consent for this.

Step 7: The employer should submit Certification Attesting to the Work and Pay Status of Employee to the SBWSCertification@sss.gov.ph upon accomplishing application.

The applicant should click the “Employer Certification Template” to download the document to be submitted.

Non-submission of the said document, however, shall not toll the processing of application for the employee’s wage subsidy.

Step 8: The SSS automated system will validate the following:

- If an employee has no pending or has not received any SSS unemployment benefit due to COVID-19

- If an employee is not a DOLE CAMP beneficiary

- If an employee has no settled or in-process SSS final claims such as funeral, retirement, death, and total disability

Step 9: The SSS system will show to the employer if an employee/s is qualified or disqualified as well as the reasons for the confirmation or denial for the wage subsidy program.

Step 10: Eligible employees will receive an email notification from the SSS that their employers have confirmed their qualification for the SBWS program.

The beneficiary will also be provided with the details on when and how they will receive their cash aids in their bank accounts or if it is available for pick-up through remittance agents.

The SSS will also notify employers that their qualified employees are “for confirmation” because of lacking credentials such as:

- The employee is not registered in the My.SSS portal

- The employee has no bank account or has no registered bank account in the My.SSS account

When is the application period?

The application period for the SBWS program will be from April 16 to 30, 2020.

What are the conditions in availing the program?

For small businesses:

Small businesses under both non-essentials that are forced to stop operations (i.e., temporary closure or suspension of work) and quasi-essentials that are allowed to operate a skeleton force can apply for the wage subsidy for employees who are not able to work and did not get paid during the ECQ. Employers in areas where other forms of quarantine have been put in place by the LGU may also qualify.

Small businesses must maintain the employment status of all eligible employee beneficiaries before the ECQ and throughout the SBWS period. This will be checked during the monitoring and evaluation stage.

Non-compliance with this condition shall result in the employer refunding to the government the wage subsidy amount.

For employees:

- Employees must be employed and active as of March 1, 2020 but unable to work during the ECQ, did not get paid for at least two weeks during the temporary closure or suspension work.

- The beneficiary can be regular, probationary, regular, seasonal, project-based, or fixed-term.

- Employees cannot resign during the enhanced community quarantine period.

When will the cash aid be disbursed?

The first tranche of payout will be from May 1 to 15, 2020 while the second tranche will be from May 16 to 31, 2020.

The schedule may change depending on the timing of the ECQ.

What are the modes of payment?

The cash assistance can be released through the following means:

- Withdrawal via employee’s SSS UMID cards enrolled as ATM

- Withdrawal from employee’s bank account for PESOnet participating banks

- Employee’s Union Bank Quick Card (partnership with SSS)

- Employee’s E-wallet such as PayMaya

- Cash pick-up arrangement through remittance transfer companies

Who is not eligible for the program?

Employees who are working from home or part of the skeleton workforce, on leave for the entire ECQ with or without pay, already a recipient of SSS unemployment benefits, and those who have settled or in-process SSS final claims are not eligible for the SBWS program.

Can those who got P5,000 cash aid from DOLE’s CAMP still receive SBWS?

Yes. However, they can only get only one tranche of the SBWS aid since their one-time P5,000 CAMP benefit is already considered one tranche.

source: GMA NEWS

0 Comments